From first contact to new country

Our approach is straightforward, guided, and designed to make your move feel manageable and within reach—from preparation to arrival.

Company Setup

We begin by mapping your business model and setting up the right company structure in your chosen jurisdiction.

Personal Tax

We design a relocation and tax strategy tailored to your profile, coordinating with advisers in your current and future countries of residence.

Golden Visa

Where available, we help you access residency options such as investor or talent visas and manage documentation with local partners.

Real Estate

We support you in selecting and structuring your home or investment property so it fits cleanly into your overall plan.

Why Wyoming?

Wyoming is chosen by many because it combines privacy, tax efficiency, and legal stability in a way few jurisdictions can match. Its LLC structure is among the strongest in the United States, offering genuine anonymity and robust protection for both personal and business assets. Investors value how easy and fast it is to establish companies here, with minimal regulatory burdens and one of the most business-friendly climates in the country. The absence of state income tax enhances wealth preservation, while Wyoming’s predictable legal system, backed by U.S. federal protections, provides long-term confidence for global investors. Beyond its business advantages, Wyoming offers pristine landscapes, a peaceful environment, and small, safe communities that appeal to those seeking both lifestyle quality and financial security.

Company Setup

Setting up a company in Wyoming is known for being remarkably fast, private, and inexpensive. Entrepreneurs can form an LLC within hours, often without the need to appear in person. The state allows complete anonymity for company owners, since member names are not required to be listed on public filings. Only a registered agent is needed to establish a Wyoming entity, making the process simple for both U.S. and international clients.

Wyoming LLCs are particularly valued for their strong charging order protections, safeguarding owners’ personal assets from business liabilities. The state has no corporate income tax, franchise tax, or capital gains tax at the state level, which significantly reduces the cost of long-term operation. Maintenance is minimal, requiring only an annual report and small fee. Because Wyoming LLCs are recognized worldwide, they serve effectively for e-commerce operations, holding companies, investment vehicles, asset protection structures, and trust integration. This combination of privacy, legal strength, and ease makes Wyoming one of the most respected corporate jurisdictions in the United States.

Visa Options (For Foreign Nationals)

Wyoming is a U.S. state, so visas are provided at the federal level. The pathways most relevant to investors or individuals planning to establish a presence in Wyoming include:

B-1/B-2 Visitor Visa

For business visits, exploration, and initial setup.

E-2 Investor Visa (Treaty Countries Only)

Allows residency through investment in a Wyoming business with renewable status.

L-1 Intracompany Transfer Visa

Supports executives or managers relocating to Wyoming to operate a U.S. branch.

EB-5 Investor Green Card

Grants permanent residency through investment in a Wyoming enterprise or regional center project.

O-1 Visa

Available for individuals with extraordinary ability in business, science, or other recognized fields.

Residency & Citizenship

Residency and citizenship are handled federally, but Wyoming becomes your state domicile once U.S. residency is obtained.

U.S. Residency

Temporary residency is possible through visas such as the E-2 or L-1, while permanent residency may be achieved via EB-5, employment sponsorship, or family sponsorship.

U.S. Citizenship

Citizenship can be pursued after holding a Green Card for typically five years and meeting all naturalization requirements.

Wyoming Advantages After Establishing Residency

Once a resident chooses Wyoming as their domicile, they benefit from no state income tax, powerful asset-protection laws, cost-effective company maintenance, and exceptional privacy over business ownership and financial structuring.

More Countries

Canada

Canada is a globally respected nation known for its political stability, high quality of life, strong economic foundations, and welcoming immigration pathways. With world-class cities, vast natural landscapes, and a reputation for safety and inclusiveness, Canada attracts entrepreneurs, investors, skilled professionals, and families from around the world. Its transparent regulatory environment, strong rule of law, and internationally trusted financial system make Canada one of the most secure jurisdictions for long-term settlement, investment, and global mobility.

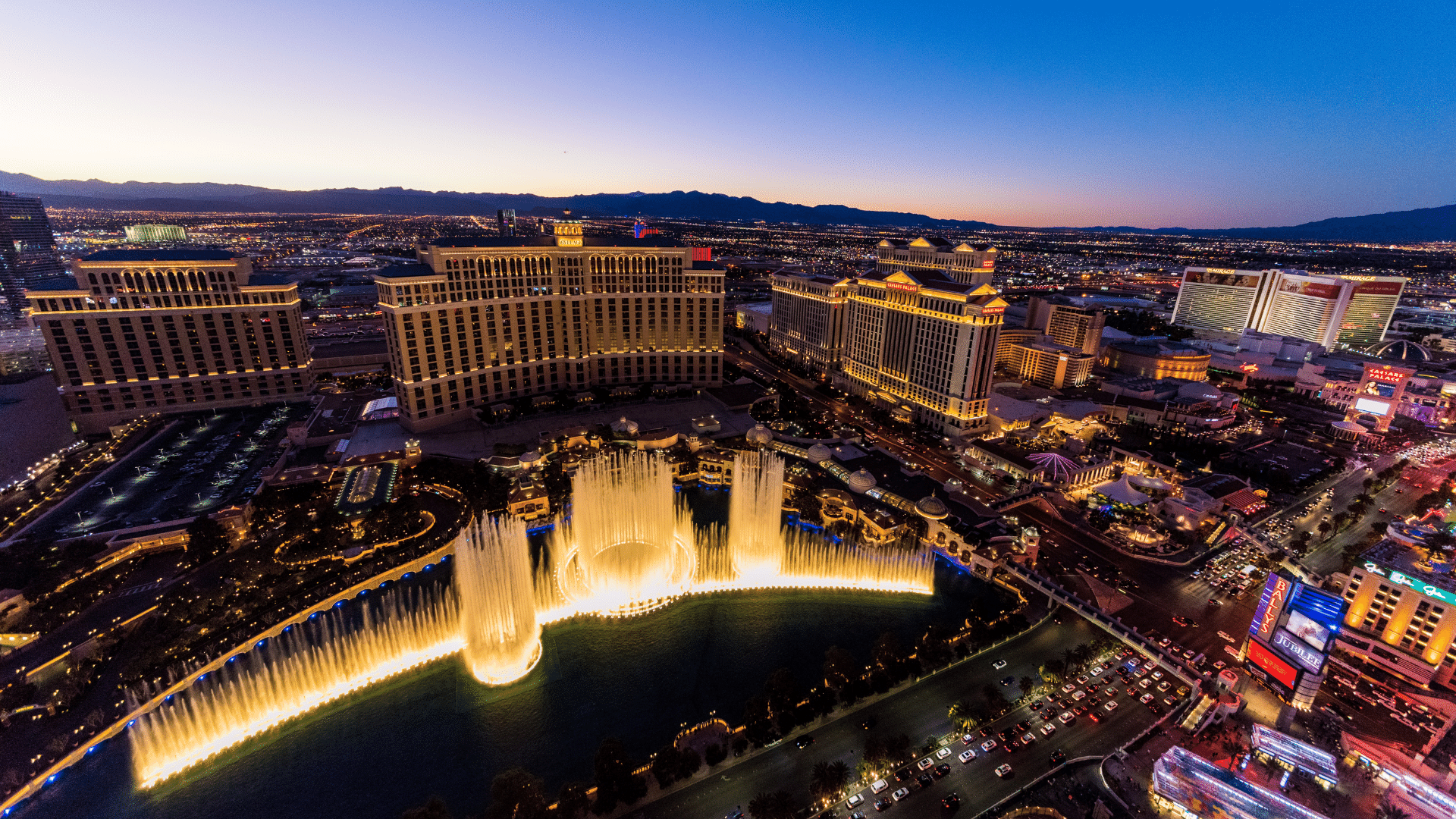

Nevada

Nevada is a dynamic U.S. jurisdiction known for its strong corporate laws, sophisticated business environment, and robust privacy protections. With a modern business infrastructure, zero state income tax, and a reputation for favorable regulatory frameworks, Nevada attracts entrepreneurs, investors, and asset-holding entities from around the world. It offers a blend of economic opportunity, predictable legal protections, and an efficient filing system supported by a pro-business government. Nevada’s unique combination of strong liability shields, flexible corporate structures, and a thriving commercial ecosystem makes it a prominent choice for international individuals seeking a credible and secure U.S. base.

Vanuatu

Vanuatu is a peaceful Pacific island nation known for its relaxed lifestyle, stable political environment, and one of the world’s fastest citizenship-by-investment programs. With natural beauty, friendly communities, and a tax-friendly system, Vanuatu attracts global investors seeking mobility, privacy, and efficient second citizenship.

.png)