From first contact to new country

Our approach is straightforward, guided, and designed to make your move feel manageable and within reach—from preparation to arrival.

Company Setup

We begin by mapping your business model and setting up the right company structure in your chosen jurisdiction.

Personal Tax

We design a relocation and tax strategy tailored to your profile, coordinating with advisers in your current and future countries of residence.

Golden Visa

Where available, we help you access residency options such as investor or talent visas and manage documentation with local partners.

Real Estate

We support you in selecting and structuring your home or investment property so it fits cleanly into your overall plan.

Why Cayman Islands

The Cayman Islands offers political stability, a world-class financial services industry, and a high standard of living. With no income tax, corporate tax, or capital gains tax, the jurisdiction is highly attractive for wealth planning, asset protection, and international business operations.

Residents enjoy a well-developed lifestyle, excellent healthcare, and a safe environment, making Cayman a premier destination for families, entrepreneurs, and high-net-worth individuals.

Company Setup

Common entity types include:

- Exempted Company (most popular)

- LLC

- Limited Partnerships

- Segregated Portfolio Companies

- Trusts & Private Trust Companies

- Funds & Investment Vehicles

Key advantages:

- Tax-neutral environment

- Strong legal protections and regulatory integrity

- Fast and efficient incorporation

- Ideal for investment funds, holding companies, structured finance, and asset protection

Visa Options

The Cayman Islands offers visa pathways suitable for short-term stays, employment, and extended living arrangements.

Visa categories include:

- Visitor & Business Visas

- Employer-Sponsored Work Permits

- Specialist visas for certain professions

- Long-Stay Extensions for qualified individuals

These support both temporary stays and transitions into residency programs.

Residency & Immigration

The Cayman Islands offers residency for investors, professionals, and financially independent individuals.

Residency options include:

- Residency Certificate for Persons of Independent Means

- Permanent Residency via long-term investment or employment

- Work-based residency through employer sponsorship

- (No citizenship-by-investment program; residency is the primary route)

More Countries

Canada

Canada is a globally respected nation known for its political stability, high quality of life, strong economic foundations, and welcoming immigration pathways. With world-class cities, vast natural landscapes, and a reputation for safety and inclusiveness, Canada attracts entrepreneurs, investors, skilled professionals, and families from around the world. Its transparent regulatory environment, strong rule of law, and internationally trusted financial system make Canada one of the most secure jurisdictions for long-term settlement, investment, and global mobility.

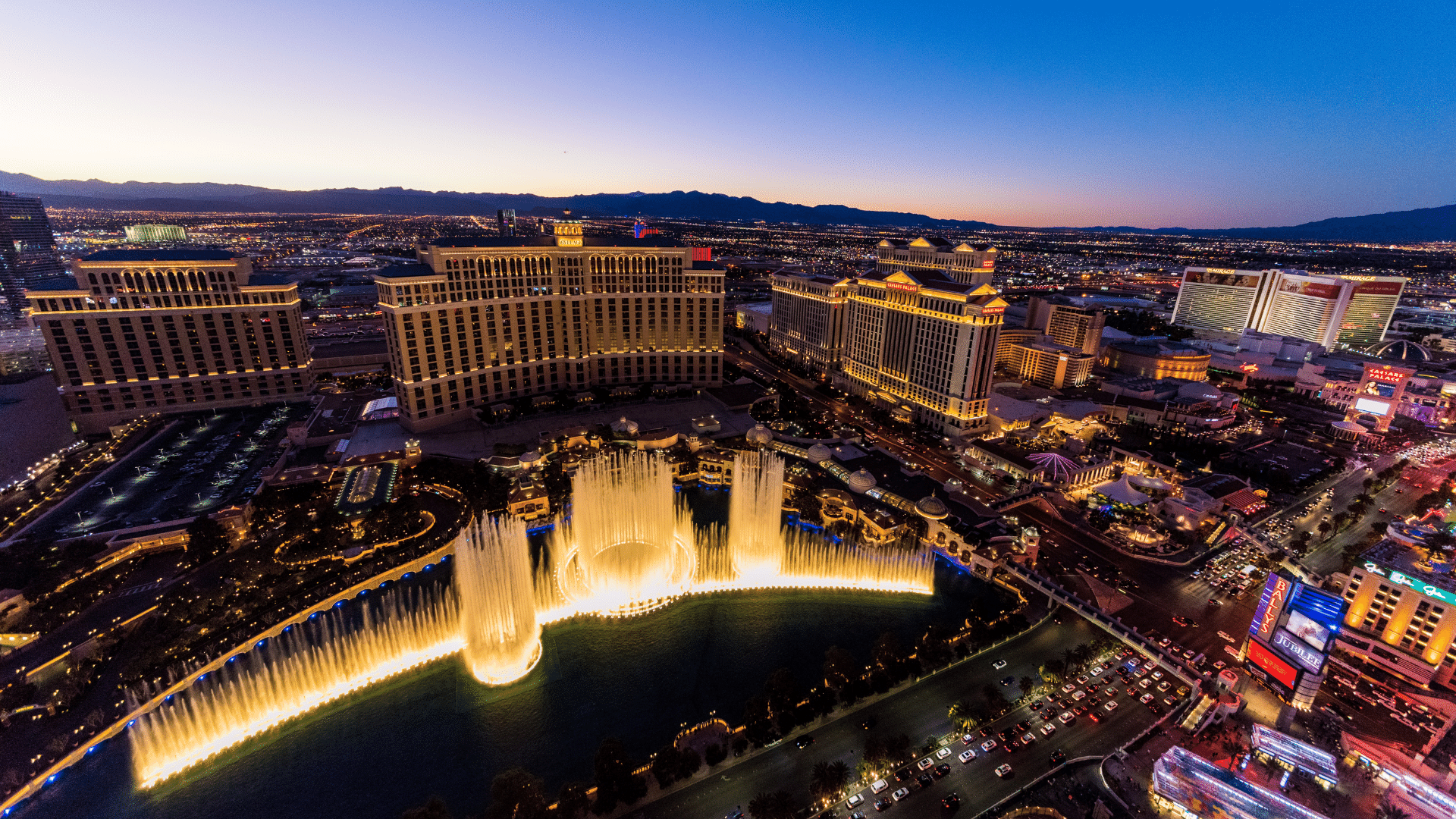

Nevada

Nevada is a dynamic U.S. jurisdiction known for its strong corporate laws, sophisticated business environment, and robust privacy protections. With a modern business infrastructure, zero state income tax, and a reputation for favorable regulatory frameworks, Nevada attracts entrepreneurs, investors, and asset-holding entities from around the world. It offers a blend of economic opportunity, predictable legal protections, and an efficient filing system supported by a pro-business government. Nevada’s unique combination of strong liability shields, flexible corporate structures, and a thriving commercial ecosystem makes it a prominent choice for international individuals seeking a credible and secure U.S. base.

Wyoming

Wyoming is a quiet, business-friendly U.S. jurisdiction known for its exceptional privacy protections, stable regulatory environment, and highly respected corporate laws. Often treated as a premier global base for asset protection and company formation, Wyoming offers a relaxed lifestyle, wide-open natural beauty, and one of the most flexible LLC structures in the United States. With no state income tax, strong anonymity options, and efficient incorporation processes, the state consistently attracts global entrepreneurs, investors, and families seeking a secure, reliable, and discreet financial home.

.png)